Cost Of Living in Mexico 2025

Average monthly spending for singles, couples, students, and families in Mexico

Whether you're living in Mexico or planning to move there, it is very important to know the cost of living and the prices of things. Here we list the average spending for the four main population groups.

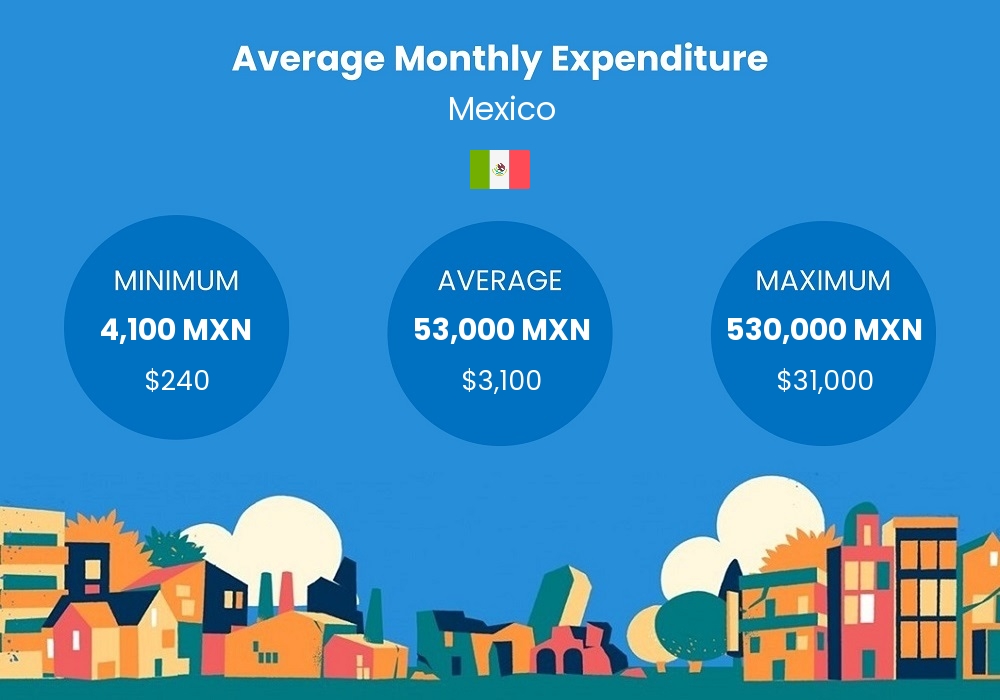

Average Monthly Expenditure

| 4,100 | 41,000 | 610,000 |

| MINIMUM | AVERAGE | MAXIMUM |

| $240 | $2,400 | $36,000 |

Monthly Expenditure ▶ Single

| 5,200 | 37,000 | 410,000 |

| MINIMUM | AVERAGE | MAXIMUM |

| $310 | $2,200 | $24,000 |

Monthly Expenditure ▶ Couple

| 8,200 | 53,000 | 490,000 |

| MINIMUM | AVERAGE | MAXIMUM |

| $480 | $3,100 | $29,000 |

Monthly Expenditure ▶ Family

| 12,000 | 61,000 | 610,000 |

| MINIMUM | AVERAGE | MAXIMUM |

| $720 | $3,600 | $36,000 |

Monthly Expenditure ▶ Student

| 4,100 | 27,000 | 300,000 |

| MINIMUM | AVERAGE | MAXIMUM |

| $240 | $1,600 | $18,000 |

Singles

The average monthly expense for a single person living in Mexico is 37,000 MXN. Expenses can range from 5,200 MXN at the minimum level to 410,000 MXN at the highest end.

Couples

The average monthly spending of couples in Mexico is 53,000 MXN. Expenditure can range from 8,200 MXN to 490,000 MXN per month.

Families

The average cost of living for families in Mexico is 61,000 MXN per month. Families spend anywhere from 12,000 MXN to 610,000 MXN.

Students

The average monthly expenditure for students in Mexico is 27,000 MXN. Students spend from 4,100 MXN to 300,000 MXN per month.

Prices and cost of goods and services in Mexico

Dining, food, and beverages costs

Fast food combo meal

| 56 MXN | 110 MXN | 190 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $3.3 | $6.6 | $11 |

Restaurant meal for one

| 190 MXN | 280 MXN | 560 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $11 | $17 | $33 |

Fine dining meal for one

| 380 MXN | 560 MXN | 2,300 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $22 | $33 | $130 |

Cappuccino or latte

| 47 MXN | 75 MXN | 110 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $2.8 | $4.4 | $6.6 |

Grocery and market costs

Milk large bottle

| 38 MXN | 45 MXN | 56 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $2.2 | $2.7 | $3.3 |

12 eggs

| 28 MXN | 38 MXN | 56 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.7 | $2.2 | $3.3 |

Fresh whole chicken

| 64 MXN | 83 MXN | 120 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $3.8 | $4.9 | $6.9 |

Pack of beef

| 75 MXN | 110 MXN | 230 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $4.4 | $6.6 | $13 |

Medium bag of rice

| 30 MXN | 41 MXN | 59 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.8 | $2.4 | $3.5 |

Bag of tomatos

| 11 MXN | 15 MXN | 28 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $0.66 | $0.88 | $1.7 |

Bag of apples

| 20 MXN | 26 MXN | 43 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.2 | $1.6 | $2.6 |

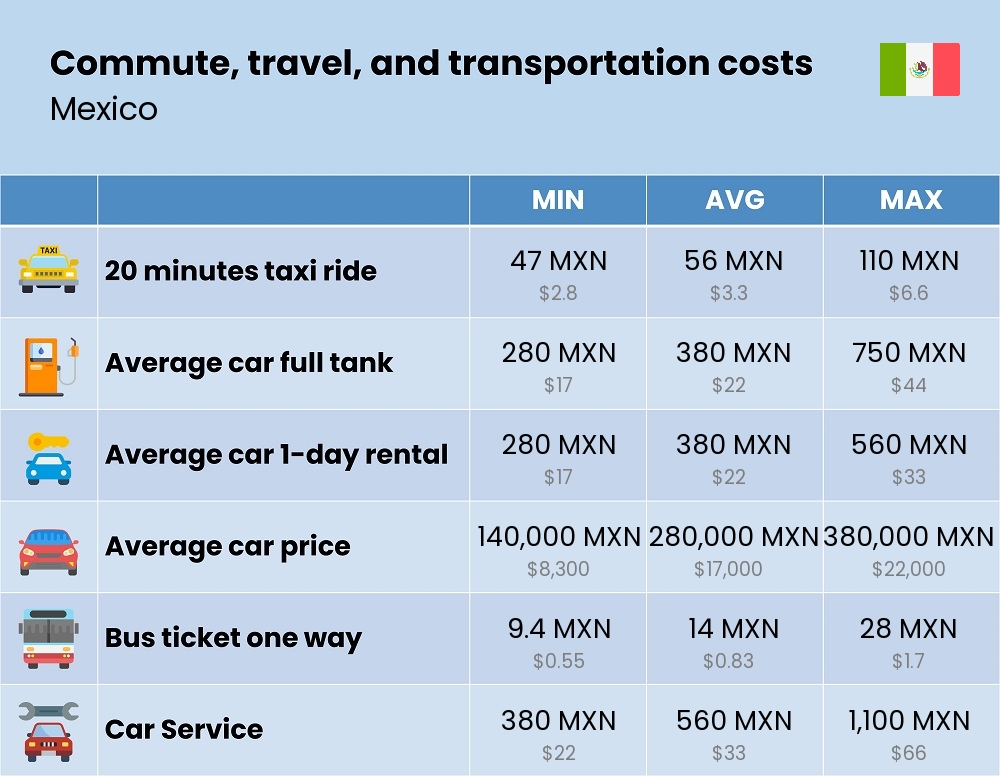

Commute, travel, and transportation costs

20 minutes taxi ride

| 47 MXN | 56 MXN | 110 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $2.8 | $3.3 | $6.6 |

Average car full tank

| 280 MXN | 380 MXN | 750 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $22 | $44 |

Average car 1-day rental

| 280 MXN | 380 MXN | 560 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $22 | $33 |

Average car price

| 140,000 MXN | 280,000 MXN | 380,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $8,300 | $17,000 | $22,000 |

Bus ticket one way

| 9.4 MXN | 14 MXN | 28 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $0.55 | $0.83 | $1.7 |

Car Service

| 380 MXN | 560 MXN | 1,100 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $22 | $33 | $66 |

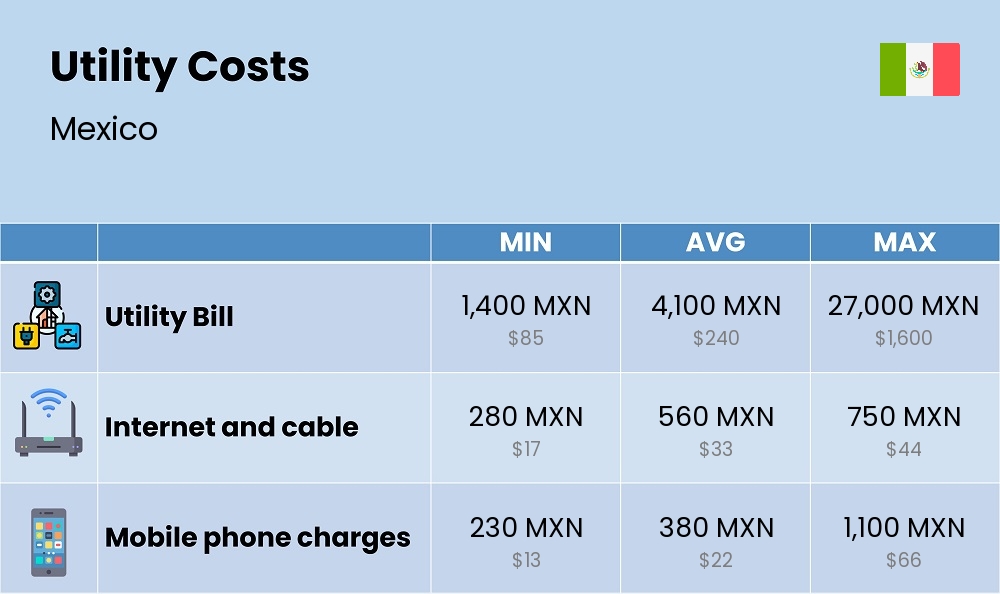

Utility cost (monthly)

Utility Bill - Individual

| 310 MXN | 2,200 MXN | 25,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $18 | $130 | $1,400 |

Utility Bill - Couple

| 330 MXN | 2,400 MXN | 27,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $19 | $140 | $1,600 |

Utility Bill - Family

| 610 MXN | 3,100 MXN | 31,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $36 | $180 | $1,800 |

Internet and cable

| 280 MXN | 560 MXN | 750 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $33 | $44 |

Mobile phone charges

| 230 MXN | 380 MXN | 1,100 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $13 | $22 | $66 |

Leisure and activities costs

Movie ticket

| 140 MXN | 190 MXN | 280 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $8.3 | $11 | $17 |

One month gym membership

| 450 MXN | 560 MXN | 1,100 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $27 | $33 | $66 |

Cloths and accessories costs

Pair of jeans or pants

| 330 MXN | 470 MXN | 700 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $20 | $28 | $41 |

Woman dress

| 310 MXN | 430 MXN | 1,400 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $18 | $26 | $83 |

Woman shoes

| 300 MXN | 400 MXN | 940 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $24 | $55 |

Men's shoes

| 260 MXN | 310 MXN | 630 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $15 | $18 | $37 |

Men suit

| 280 MXN | 350 MXN | 1,900 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $21 | $110 |

Regular t-shirt

| 140 MXN | 190 MXN | 560 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $8.3 | $11 | $33 |

Housing costs / monthly rent

Studio apartment

| 4,700 MXN | 7,000 MXN | 19,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $280 | $410 | $1,100 |

1-bedroom apartment

| 7,000 MXN | 11,000 MXN | 28,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $410 | $660 | $1,700 |

2-bedroom apartment

| 9,400 MXN | 14,000 MXN | 38,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $550 | $830 | $2,200 |

Housing costs / Buying

Studio apartment

| 940,000 MXN | 1.4M MXN | 2.8M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $55,000 | $83,000 | $170,000 |

1-bedroom apartment

| 1.1M MXN | 1.9M MXN | 7M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $66,000 | $110,000 | $410,000 |

2-bedroom apartment

| 1.9M MXN | 5.6M MXN | 11M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $110,000 | $330,000 | $660,000 |

Furniture Costs

King Size Bed

| 5,600 MXN | 7,000 MXN | 9,400 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $330 | $410 | $550 |

Double Bed

| 3,800 MXN | 5,600 MXN | 7,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $220 | $330 | $410 |

Single Bed

| 3,300 MXN | 4,300 MXN | 5,600 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $200 | $260 | $330 |

Living Room

| 6,300 MXN | 8,000 MXN | 28,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $370 | $470 | $1,700 |

Dining Table

| 2,800 MXN | 3,800 MXN | 7,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $170 | $220 | $410 |

Sofa or Couch

| 3,800 MXN | 5,100 MXN | 11,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $220 | $300 | $660 |

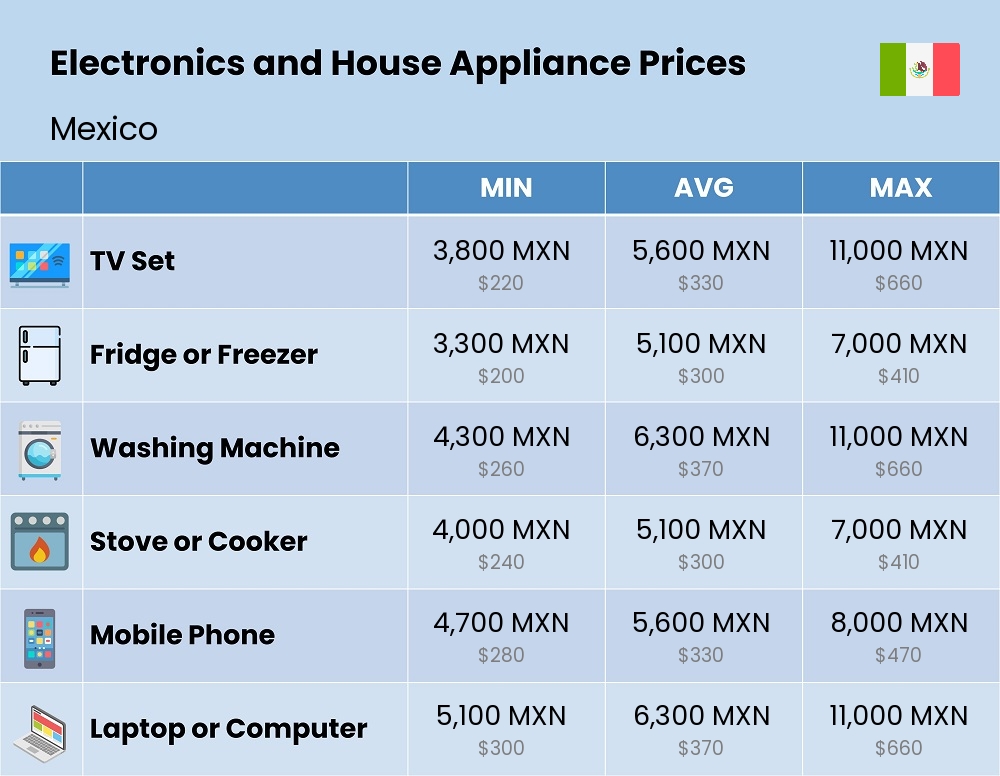

Electronics and House Appliance Costs

TV Set

| 3,800 MXN | 5,600 MXN | 11,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $220 | $330 | $660 |

Fridge or Freezer

| 3,300 MXN | 5,100 MXN | 7,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $200 | $300 | $410 |

Washing Machine

| 4,300 MXN | 6,300 MXN | 11,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $260 | $370 | $660 |

Stove or Cooker

| 4,000 MXN | 5,100 MXN | 7,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $240 | $300 | $410 |

Mobile Phone

| 4,700 MXN | 5,600 MXN | 8,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $280 | $330 | $470 |

Laptop or Computer

| 5,100 MXN | 6,300 MXN | 11,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $300 | $370 | $660 |

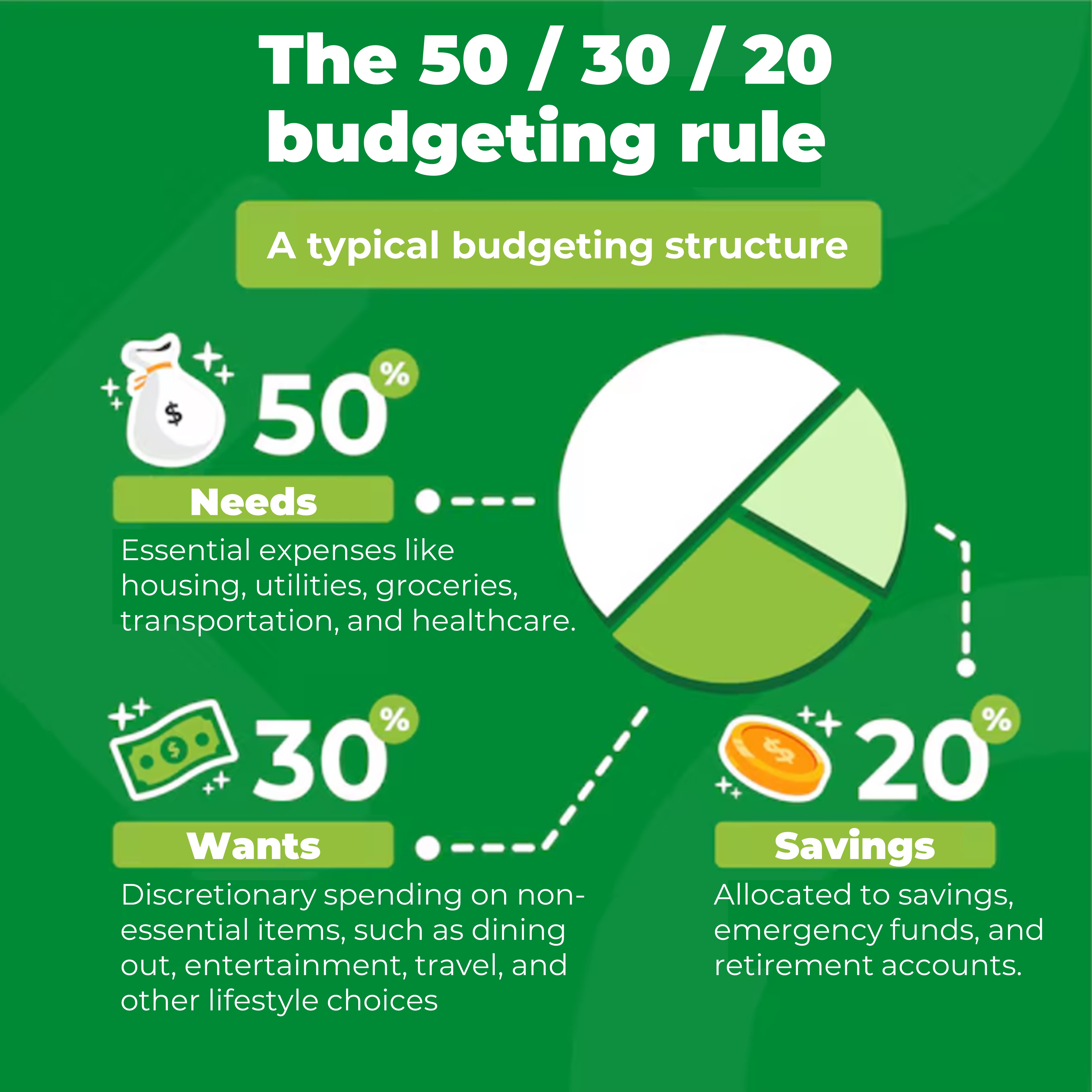

A typical and healthy budgeting structure

The 50/30/20 rule

Spending among different people can vary significantly based on factors such as their income, lifestyle, location, and personal preferences. A commonly used guideline for budgeting is the 50/30/20 rule, which suggests allocating your income into three main categories in the following percentages.

50% for needs and financial obligations

This category includes essential expenses like housing, utilities, groceries, transportation, and healthcare.

30% for wants and discretionary spending

This category covers discretionary spending on non-essential items, such as dining out, entertainment, travel, and other lifestyle choices.

20% for savings and emergency fund

This is the percentage that must be allocated to savings, emergency funds, and retirement accounts.

About financial planning, money management, and household budgeting

The 50/30/20 rule is used as a general guideline but may not be the best choice for all people. There are in fact many budgeting plans out there like the 70/20/10 and the 60/20/20 rules, all claiming to be the best. More important than all of this is to establish financial discipline by creating a budget tailored to your specific financial goals and situation. It is very important that your financial outflow be less than your income to maintain a healthy cash flow.

Emergency Funds

An emergency fund is a financial safety net comprised of easily accessible savings set aside to cover unexpected expenses or financial emergencies, typically amounting to three to six months' worth of living expenses. We asked residents whether they have an emergency fund and the answers were as follows.

Yes69%

No31%

Based on the survey, 31% of the people living in Mexico said that they don't have an emergency fund while 69% said that they do.

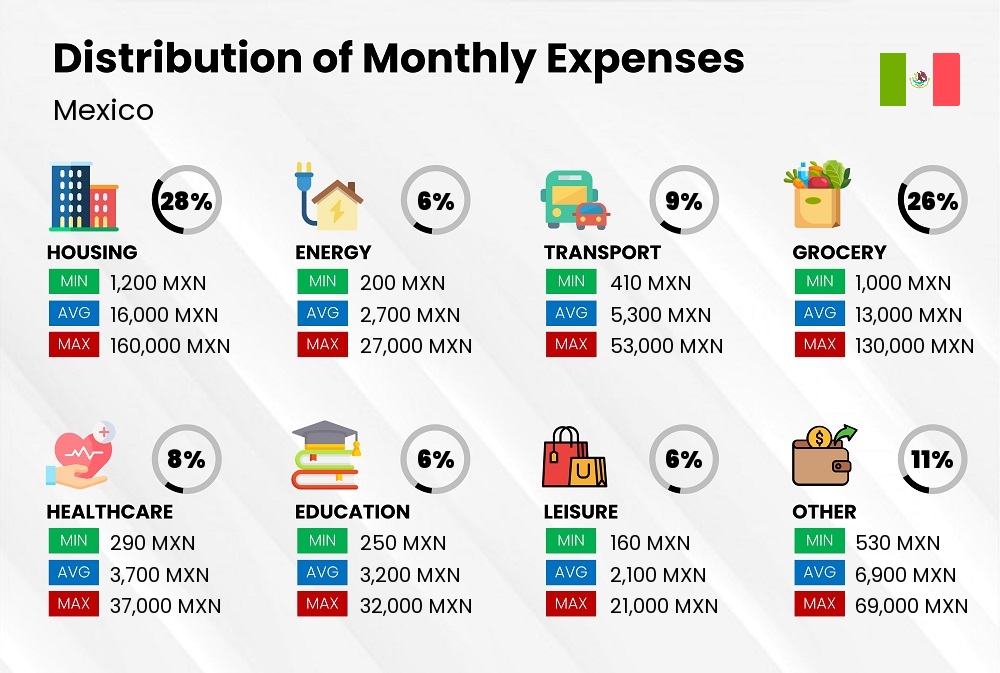

How do people spend their money in Mexico?

We asked thousands of people about their spending habits and expenditure breaks. Below are their answers.

Housing Expenditure28%

28% of total expenses on average (17% to 36%)

| LOW | $72 1,200 MXN |

| AVERAGE | $720 12,000 MXN |

| HIGH | $11,000 180,000 MXN |

| Per Month |

People living in Mexico typically spend from 17% to 36% of their total monthly expenditure on housing with 28% being the average. The average spend on housing is 12,000 MXN with expenditure ranging from 1,200 MXN to 180,000 MXN. This cost mainly goes for rent but it also includes other accommodation-related expenses. Housing costs are highest for families and lowest for students as expected.

Utilities, Electricity, Water, Internet, Mobile6%

6% of total expenses on average (3% to 10%)

| LOW | $12 200 MXN |

| AVERAGE | $120 2,000 MXN |

| HIGH | $1,800 31,000 MXN |

| Per Month |

Utility expenditure like electricity, water, and gas in Mexico ranges from 3% to 10% of total expenses with 6% being the average. The average monthly cost of utilities is 2,000 MXN with 200 MXN and 31,000 MXN being the upper and lower limits.

Transport, Fuel, Commute9%

9% of total expenses on average (4% to 13%)

| LOW | $24 410 MXN |

| AVERAGE | $240 4,100 MXN |

| HIGH | $3,600 61,000 MXN |

| Per Month |

Fuel consumption and cost of transport depend heavily on whether you live near your work or school, but roughly speaking you would expect to spend from 410 MXN to 61,000 MXN on commuting with 4,100 MXN being the norm for most people in one month. This means that money spent on transport constitutes about 9% of total spending on average but can go as low as 4% or as high as 13%.

Food and Groceries Cost26%

26% of total expenses on average (18% to 32%)

| LOW | $60 1,000 MXN |

| AVERAGE | $600 10,000 MXN |

| HIGH | $9,100 150,000 MXN |

| Per Month |

The average outlay on groceries in a month in Mexico is 10,000 MXN. The cost of groceries can range between 1,000 MXN to 150,000 MXN. People spend on average about 26% on food and groceries with upper and lower bounds of 18% and 32% respectively.

Healthcare and Medical Services8%

8% of total expenses on average (3% to 11%)

| LOW | $17 290 MXN |

| AVERAGE | $170 2,900 MXN |

| HIGH | $2,500 43,000 MXN |

| Per Month |

People in Mexico allocate 3% to 11% of their total monthly expenditure to healthcare including health insurance and out-of-pocket medical expenses. The average spending is around 8%. The range of medical expenses range from 290 MXN to 43,000 MXN with 2,900 MXN being the norm.

Leisure and Shopping6%

6% of total expenses on average (3% to 10%)

| LOW | $9.7 160 MXN |

| AVERAGE | $97 1,600 MXN |

| HIGH | $1,400 25,000 MXN |

| Per Month |

This category mostly contains discretionary or non-essential expenses but also some non-discretionary spending like furniture for example. The monthly expenses range from 160 MXN to 25,000 MXN with 1,600 MXN being the average. Speaking of percentages, that equates to 3% to 10% of total expenses with an average of 6% for most residents.

Education and Schooling6%

6% of total expenses on average (4% to 12%)

| LOW | $14 250 MXN |

| AVERAGE | $140 2,500 MXN |

| HIGH | $2,200 37,000 MXN |

| Per Month |

Spending on education can vary drastically between different people. While working singles can spend 0% on education, families and students' expenditure can reach up to 22%. On average, education constitutes 6% of the monthly expenditure with 4% and 12% being the lower and upper bounds respectively. The average reported education cost is 2,500 MXN per month with 250 MXN being the minimum spent amount and 37,000 MXN being the maximum.

Other Expenses11%

11% of total expenses on average (6% to 18%)

| LOW | $31 530 MXN |

| AVERAGE | $310 5,300 MXN |

| HIGH | $4,700 80,000 MXN |

| Per Month |

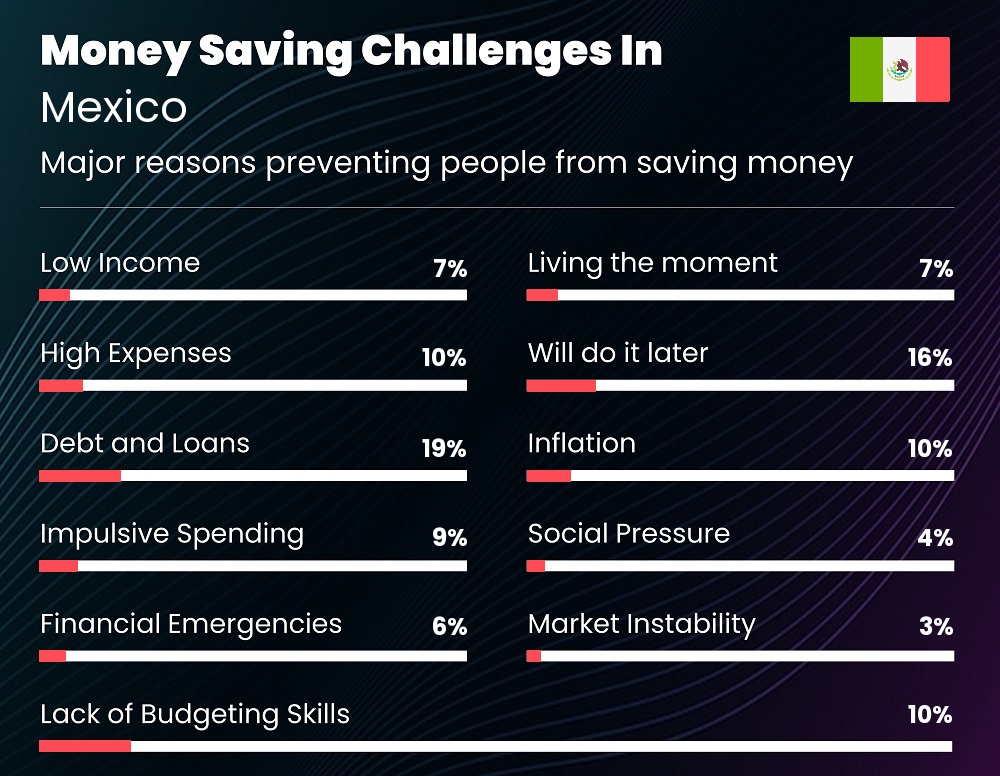

Saving Challenges in Mexico

Reasons that make it difficult for people to save money

We wanted to understand what is stopping people from maximizing their savings in Mexico. Listed below are the answers given by the survey participants.

| Reason | % People |

|---|---|

| Low Income | 7% |

| High Expenses | 10% |

| Debt and Loans | 19% |

| Lack of Budgeting Skills | 10% |

| Impulsive Spending | 9% |

| Financial Emergencies | 6% |

| Living the moment | 7% |

| Will do it later | 16% |

| Inflation | 10% |

| Social Pressure | 4% |

| Market Instability | 3% |

Around 7% of the people said that their salary is too low to accommodate a portion for savings while 10% said that the high cost of living leaves little room for savings. 19% of the residents said that they are burdened with debt and find it challenging to save money. 10% reported that they just don't have the knowledge or discipline to create and stick to a budget, leading to overspending and an inability to save. 9% blamed impulsive spending as the reason for saving inability. Around 6% said that unexpected expenses like medical bills or car repairs are derailing their savings goals. 7% bluntly said that they don't see the purpose of it and prefer to live each day to the fullest. 16% reported that they understand the value of saving but are putting off saving for the future, thinking they have plenty of time to start later. 10% blamed inflation, saying that every time they save some money they end up using it immediately. A surprising 4% said that social pressure and keeping up with peers or social expectations makes them overspend. Lastly, 3% blamed market instability and price fluctuations.

Low-cost alternatives in Mexico

People are always looking for ways to cut down expenses and reduce expenditures. The hallmark of any affordable place is the availability of discount stores, bargain deals, smart or secondhand shopping, refurbished items, and couponing. We asked residents how easily cost-cutting is and the answers were distributed as follows:

Plenty of low-cost options60%

Few low-cost options40%

Based on the survey, 60% of the people living in Mexico have no problem finding low-cost alternatives to support a frugal lifestyle while 40% think that thriftness is difficult due to scarcity in discount markets and secondhand outlets.

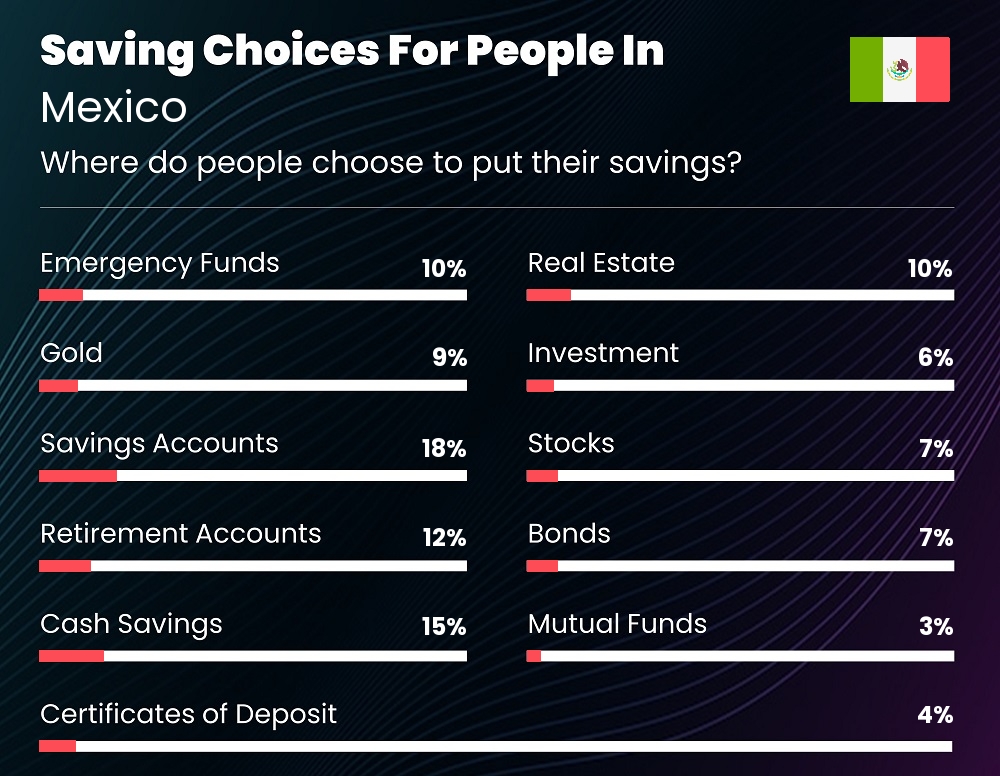

Typical saving choices for people in Mexico

Where do people choose to put their savings?

| Saving Type | % People |

|---|---|

| Emergency Funds | 10% |

| Gold | 9% |

| Savings Accounts | 18% |

| Retirement Accounts | 12% |

| Cash Savings | 15% |

| Real Estate | 10% |

| Investment | 6% |

| Stocks | 7% |

| Bonds | 7% |

| Mutual Funds | 3% |

| Certificates of Deposit | 4% |

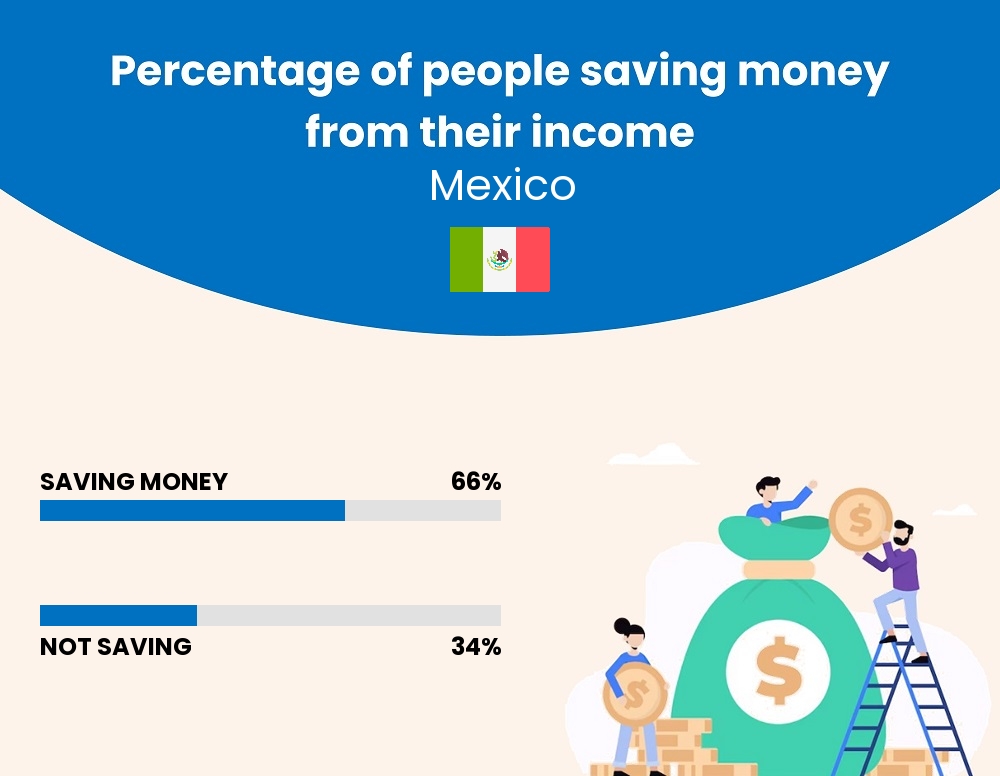

How much money can you save in Mexico every month?

We asked thousands of people what percentage of their income can they save in a month. Below are the answers.

What percentage of people in Mexico manage to save money from their income every month?

Almost 66% of the surveyed people in Mexico said that they can save some money at the end of each month while 34% said that aren't saving anything.

Percentage of people saving money by population group in Mexico

| Group | Savers | Non Savers |

|---|---|---|

| Singles | 68% | 32% |

| Couples | 63% | 37% |

| Families | 58% | 42% |

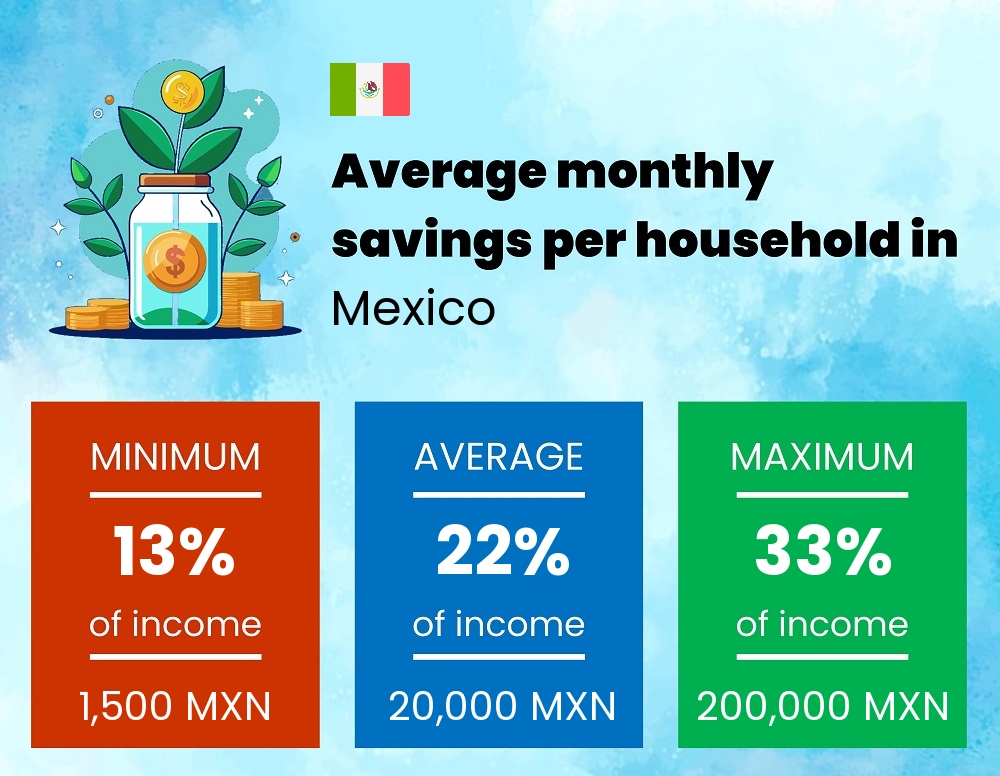

Savings-to-Income Ratio

The savings-to-income ratio is measured as the percentage of income that people save over a specific period and it is simply calculated by dividing the saved money by total income and then multiplying the result by 100. (Savings / Income) x 100.

Saving to Income Ratio

| 13% | 22% of income | 33% |

| MINIMUM | AVERAGE | MAXIMUM |

Average Monthly Saved Amount

| 1,500 MXN $90 | 15,000 MXN $900 | 230,000 MXN $14,000 |

| MINIMUM | AVERAGE | MAXIMUM |

For most people, 13% to 33% of their monthly income is what they can allocate to their savings, with 22% being the average. The amount of money that people can save is approximately 15,000 MXN on average with savings ranging from 1,500 MXN to 230,000 MXN.

68% of surveyed singles reported some of their income going to savings while 63% of couples said the same. 58% of families confirmed their ability to save money.

How much money do people actually save in Mexico?

Singles

Singles

Saving to Income Ratio

| 16% | 26% of income | 35% |

| MINIMUM | AVERAGE | MAXIMUM |

Average Monthly Saved Amount

| 1,500 MXN $90 | 14,000 MXN $810 | 150,000 MXN $9,000 |

| MINIMUM | AVERAGE | MAXIMUM |

Savings to income distribution levels for singles

| Saving To Income Ratio | % Singles |

|---|---|

| 0% - 10% | 27% |

| 10% - 20% | 22% |

| 20% - 30% | 15% |

| 30% - 40% | 18% |

| 40% - 50% | 13% |

| > 50% | 5% |

Interpretation and Analysis

Singles who can afford to save reported that they allocate from 16% to 35% of their monthly income to savings, with 26% being the average for most singles. The average amount of money that singles are able to save is 14,000 MXN with 1,500 MXN and 150,000 MXN being the minimum and maximum respectively.

Couples

Couples

Saving to Income Ratio

| 14% | 24% of income | 34% |

| MINIMUM | AVERAGE | MAXIMUM |

Average Monthly Saved Amount

| 3,100 MXN $180 | 20,000 MXN $1,200 | 180,000 MXN $11,000 |

| MINIMUM | AVERAGE | MAXIMUM |

Savings to income distribution levels for couples

| Saving To Income Ratio | % Couples |

|---|---|

| 0% - 10% | 31% |

| 10% - 20% | 24% |

| 20% - 30% | 18% |

| 30% - 40% | 13% |

| 40% - 50% | 10% |

| > 50% | 4% |

Interpretation and Analysis

Couples who confirmed their ability to save reported saving equivalent to 14% to 34% of their monthly income, with 24% being the average for most couples. The average amount of money that couples can save is 20,000 MXN with 3,100 MXN and 180,000 MXN being the minimum and maximum respectively.

Families

Families

Saving to Income Ratio

| 12% | 20% of income | 30% |

| MINIMUM | AVERAGE | MAXIMUM |

Average Monthly Saved Amount

| 4,600 MXN $270 | 23,000 MXN $1,400 | 230,000 MXN $14,000 |

| MINIMUM | AVERAGE | MAXIMUM |

Savings to income distribution levels for families

| Saving To Income Ratio | % Families |

|---|---|

| 0% - 10% | 34% |

| 10% - 20% | 27% |

| 20% - 30% | 19% |

| 30% - 40% | 10% |

| 40% - 50% | 7% |

| > 50% | 3% |

Interpretation and Analysis

Families in Mexico can save anywhere between 12% to 30% of their monthly income, with 20% being the average for most families. The average amount of money that families can put aside is 23,000 MXN with 4,600 MXN and 230,000 MXN being the minimum and maximum respectively.

Affordable living in Mexico

Income and cost of living compatibility

We asked residents one simple question and recorded their answers.

Is it affordable or economical to live in Mexico?

Around 70% of surveyed residents think that living in Mexico is affordable with proper budgeting while 30% reported that it is just too expensive and not affordable even with frugality and thriftness.

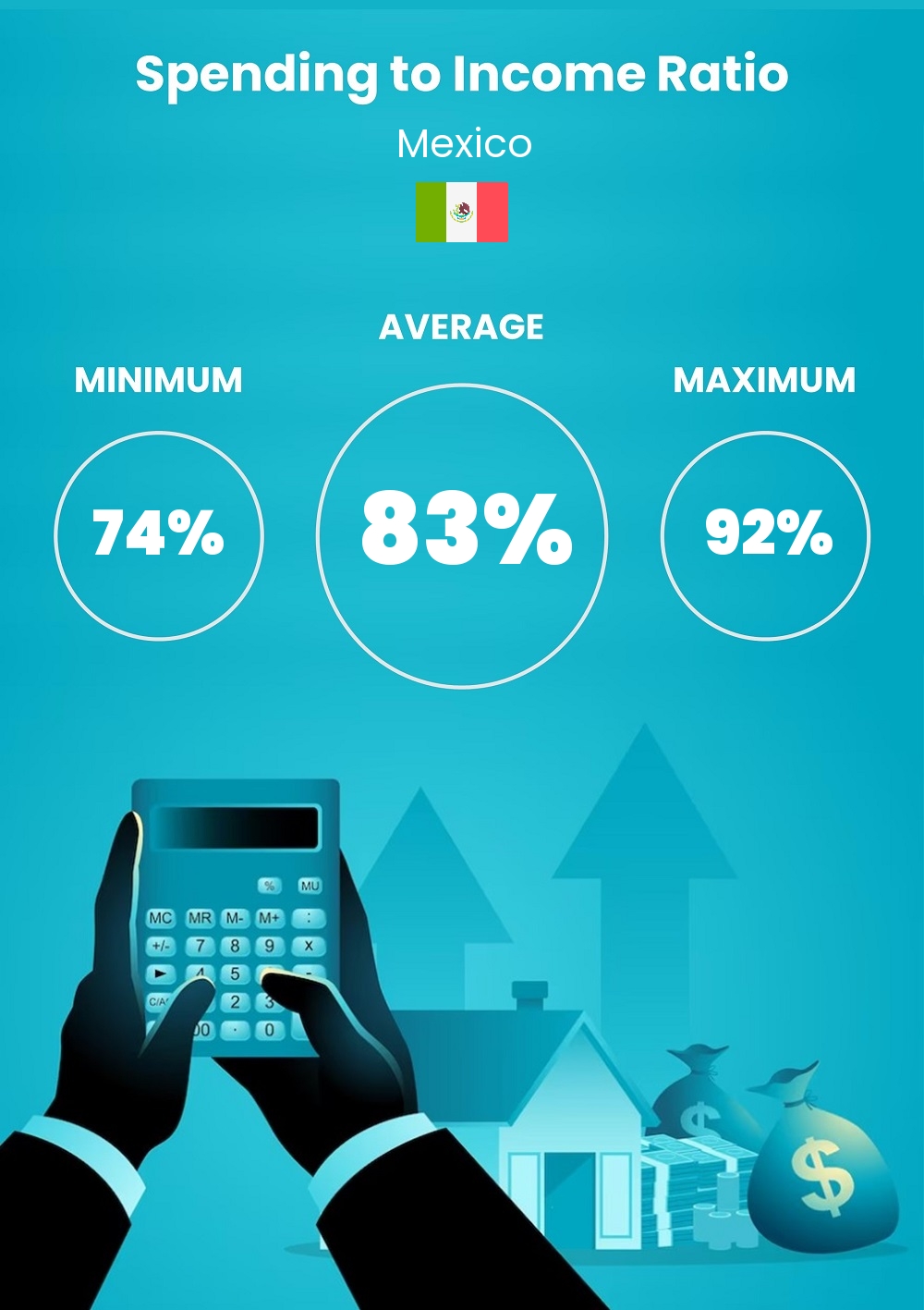

Expenditure to Income Ratio in Mexico

One of the most definite ways to determine how affordable a place is measuring the ratio of expenses to salary. A high expense-to-income to ratio indicates a high cost-of-living index while a low expenditure-to-salary ratio means the place is affordable to live in.

83%

74% to 92%

( expenditure / income ) x 100

Expense to income distribution levels

| Spending To Income Ratio | % People |

|---|---|

| < 50% | 7% |

| 50% - 60% | 12% |

| 60% - 70% | 19% |

| 70% - 80% | 27% |

| 80% - 90% | 14% |

| 90% - 100% | 8% |

| 100% - 110% | 5% |

| 110% - 120% | 3% |

| 120% - 130% | 2% |

| 130% - 140% | 1% |

| > 140% | 1% |

Interpretation and Analysis

The average spending-to-salary ratio in Mexico is 83% This means that on average, people spend around 83% of their income for living. According to the distribution table, 19% of the population spend approximately 60% to 70% of their income every month.

How can spending be more than income?

A value higher than 100% means that the expenditure of those people is higher than their income. They are spending more than what they earn. This is possible in two scenarios. They are either borrowing from their savings to survive or they are borrowing from other sources (relatives, friends, banks, etc.). More about this in the debt section.

Individual

75%

Spending-Income-Ratio

Couple

79%

Spending-Income-Ratio

Family

87%

Spending-Income-Ratio

Financial Literacy in

Financial literacy is the knowledge of concepts and principles related to personal finance that allow individuals to make informed decisions regarding their money such as budgeting, saving, investing, borrowing, managing debt, financial risk management, and planning.

Financial Leteracy65%

We asked residents of whether they acquired any adequate personal financial training in their lives. Approximately 35% of the people who participated in the survey said that they are not well informed about the topics of budgeting, saving, etc., and just manage things based on their own experience, while 65% said that they know about the general principles of personal finance from sources other than their own experience.

Difficulty in Budgeting and Financial Planning

We wanted to understand whether residents of have problems or difficulties in managing their expenditures and savings so we asked people one simple question: do you struggle with your personal finances? 28% of the participants reported that they indeed struggle in creating budgets and in organizing their finances while 72% said that they have everything under control.

Struggles with finance28%

Easily manages finances72%

Housing costs, accommodation, and housing affordability in Mexico

Rental costs and house/apartment prices can vary drastically between different areas and locations.

Rent Cost in Mexico

Monthly Rent Prices

Studio apartment monthly rent cost

| 4,700 MXN | 7,000 MXN | 19,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $280 | $410 | $1,100 |

1-bedroom apartment monthly rent cost

| 7,000 MXN | 11,000 MXN | 28,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $410 | $660 | $1,700 |

2-bedroom apartment monthly rent cost

| 9,400 MXN | 14,000 MXN | 38,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $550 | $830 | $2,200 |

3-bedroom apartment monthly rent cost

| 11,000 MXN | 19,000 MXN | 51,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $660 | $1,100 | $3,000 |

Furnished apartment monthly rent cost

| 23,000 MXN | 56,000 MXN | 110,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1,300 | $3,300 | $6,600 |

Townhouse monthly rent cost

| 19,000 MXN | 28,000 MXN | 80,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1,100 | $1,700 | $4,700 |

House monthly rent cost

| 23,000 MXN | 56,000 MXN | 110,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1,300 | $3,300 | $6,600 |

Villa monthly rent cost

| 28,000 MXN | 70,000 MXN | 110,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1,700 | $4,100 | $6,600 |

The monthly rental cost of a studio apartment in Mexico ranges between 4,700 MXN and 19,000 MXN, meanwhile the cost of monthly rental of a one-bedroom apartment can be anywhere from 7,000 MXN to 28,000 MXN. Two-bedroom rentals rate ranges between 9,400 MXN and 38,000 MXN per month. The monthly rental for a three-bedroom apartment ranges from 11,000 MXN to 51,000 MXN. The average rent of a townhouse in Mexico is around 28,000 MXN while house rental costs can be as high as 56,000 MXN per month. Finally, if you want to rent a villa, expect to pay anywhere from 28,000 MXN to 110,000 MXN per month.

Apartment and house prices in Mexico

Cost of buying a property

Studio apartment price

| 940,000 MXN | 1.4M MXN | 2.8M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $55,000 | $83,000 | $170,000 |

1-bedroom apartment price

| 1.1M MXN | 1.9M MXN | 7M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $66,000 | $110,000 | $410,000 |

2-bedroom apartment price

| 1.9M MXN | 5.6M MXN | 11M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $110,000 | $330,000 | $660,000 |

3-bedroom apartment price

| 6.3M MXN | 9.4M MXN | 28M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $370,000 | $550,000 | $1.7M |

Townhouse price

| 8M MXN | 19M MXN | 70M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $470,000 | $1.1M | $4.1M |

House price

| 9.4M MXN | 56M MXN | 80M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $550,000 | $3.3M | $4.7M |

Villa price

| 11M MXN | 63M MXN | 94M MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $660,000 | $3.7M | $5.5M |

The average price of a studio apartment in Mexico can range from 940,000 MXN to 2.8M MXN depending on location. One bedroom cost can be anywhere from 1.1M MXN to 7M MXN. A villa can cost you 63M MXN on average with prices ranging from 11M MXN to 94M MXN.

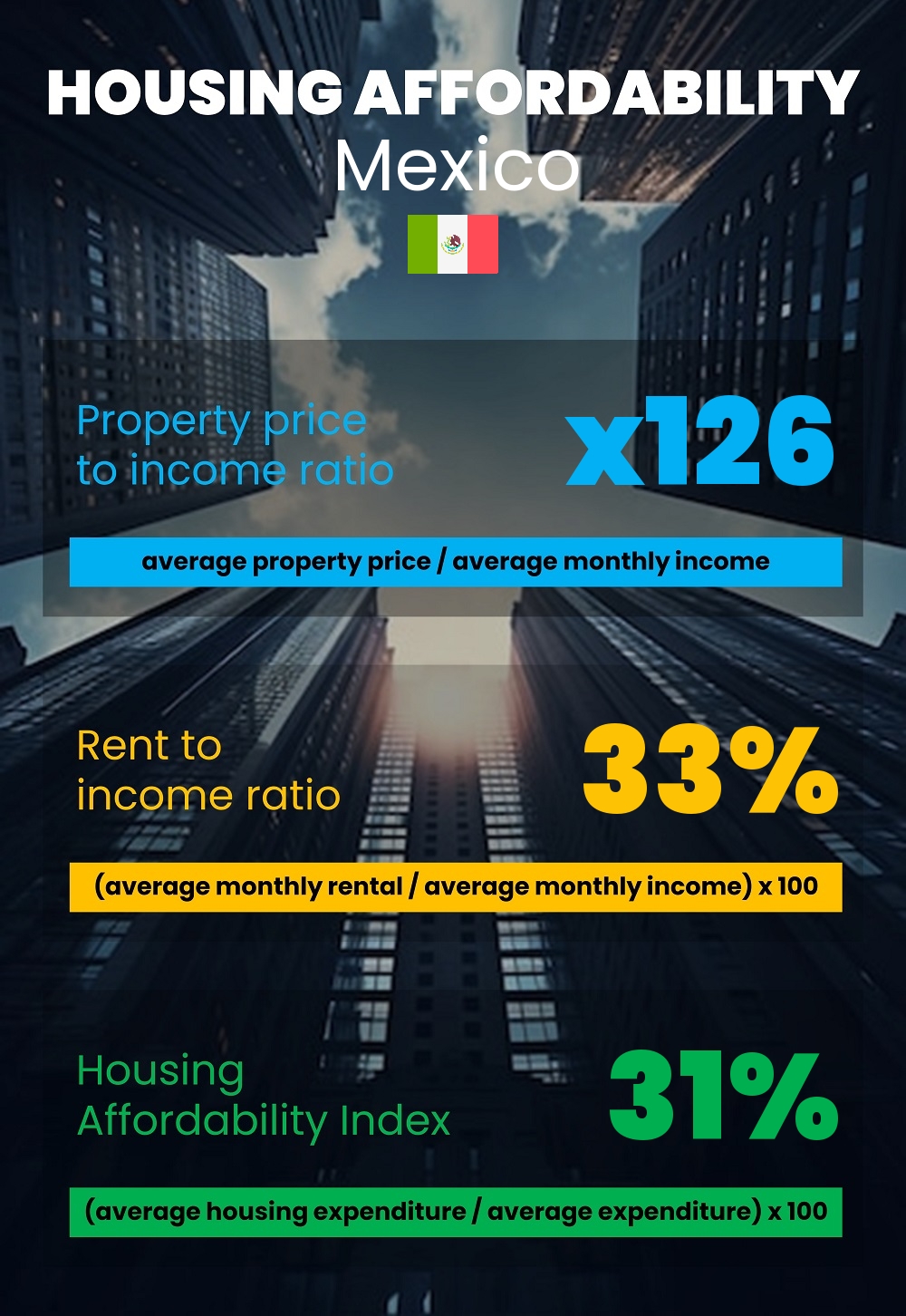

House / apartment prices to income ratio

Property price to income ratio

( average property price / average monthly income ) x 100

| 43 | x126 monthly income | 216 |

| MINIMUM | AVERAGE | MAXIMUM |

Property prices in Mexico can be x126 to x216 multiples of the monthly income depending on the property and the income of the person. On average, property prices are approximately x126 multiples of the average monthly salary in Mexico.

Rent to income ratio

Rent to income ratio

( monthly rental / monthly income ) x 100

| 23% | 33% of income | 43% |

| MINIMUM | AVERAGE | MAXIMUM |

The average rent-to-income ratio in Mexico is around 33%. This means that people pay 33% of their income for rent. Those figures can range from 23% to 43% depending on the salary, location, and type of property.

Housing affordability index

The housing affordability index measures how affordable accommodation is in a particular place. This can measured in multiple ways, the most common being housing expenditure to total expenditure ratio and the rent to income ratio. The housing expenditure ratio is a figure reported by individuals on the percentage they allocate for housing. Rent to income ratio is calculated by dividing the average monthly rent by the average income. Because these values are both percentages, we can find their average and get the best of the two worlds.

Property Taxes

Real estate owners pay property taxes to local tax authorities, which are determined by the assessed value of their property. Typically, these taxes are paid once a year. Property tax funds contribute to community development, financing infrastructure improvements, public services, and local education initiatives.

Home Maintenance Costs

Home maintenance costs encompass various expenses associated with the upkeep and repair of a residence. These expenditures include regular tasks such as lawn care, pest control, and HVAC system servicing, as well as occasional repairs and renovations like fixing leaks, painting, or replacing appliances.

| 82 MXN | 820 MXN | 12,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

Urban vs. rural living costs

Urban living typically entails higher housing and transportation costs due to demand and limited space, while rural areas generally offer lower housing expenses but may have higher prices for goods and services. The differnce in rental rates between urban areas and rural areas can be as high as 300% in some cases.

Financial goals of people in Mexico

In an attempt to understand the economic situation in Mexico, we asked participants about their financial targets. By knowing what the population in general is trying to achieve, we can shed light on the economic outlook, cost of living, and quality of life in general.

| Financial Goal | % People |

|---|---|

| Emergency Fund | 6% |

| Debt Reduction | 30% |

| Retirement Savings | 7% |

| Education Funding | 9% |

| Homeownership | 16% |

| Investing | 9% |

| Travel or Lifestyle | 12% |

| Healthcare Expenses | 8% |

| Financial Independence | 9% |

Around 6% of those who participated in the survey said that their main goal is to establish an emergency fund to cover unexpected expenses while 30% said their number one priority is to pay off high-interest debt or loans and improve credit. 7% of surveyed people confirmed that saving for retirement to ensure a comfortable lifestyle in the final years is their main target. Around 9% reported that their priority is saving for the tuition fees and education costs of their children while 16% choose to buy a home or pay off existing mortgage before other things. 9% of the population would like to build wealth through investments such as stocks, bonds, mutual funds, or real estate. For 12% of people, saving for vacations or upgrading their lifestyle is the number one concern. Approximately 8% of the residents said that saving for healthcare expenses including insurance premiums is their main goal.

Retirement, pension plans, and life after work in Mexico

What does the retirement lifestyle look like in Mexico and how much retirement savings are required?

Retirement age

The retirement age for most employees in is 65 years. Specific retirement ages can vary based on factors like occupation, gender, years of contribution, and location. It is not entirely unlikely for people to retire either before or after this age.

Retirement planning and savings

There are many retirement saving options, some are personally initiated and others are government-sponsered. Regardless of the source of savings, the minimum amount of money that needs to be put aside to ensure a peaceful and comfortable retirement at each age can be found in the table below. This data is largely approximated and can vary drastically based on individual needs and situations. Treat these figures as a general guideline.

The typical saved amount of money you should have at every age as multiples of monthly salary:

| Age | Amount |

|---|---|

| 25 | 5x monthly salary at age 25 |

| 30 | 10x monthly salary at age 30 |

| 35 | 15x monthly salary at age 35 |

| 40 | 25x monthly salary at age 40 |

| 45 | 32x monthly salary at age 45 |

| 50 | 48x monthly salary at age 50 |

| 55 | 56x monthly salary at age 55 |

| 60 | 64x monthly salary at age 60 |

| 65 | 78x monthly salary at age 65 |

The typical average saved amount of money you should have at every age in Mexico:

| Age | Amount |

|---|---|

| 25 | 110,000 MXN |

| 30 | 230,000 MXN |

| 35 | 390,000 MXN |

| 40 | 560,000 MXN |

| 45 | 840,000 MXN |

| 50 | 1.2M MXN |

| 55 | 1.4M MXN |

| 60 | 1.7M MXN |

| 65 | 2.1M MXN |

Retirement Income Distribution

We asked residents about their retirement income sources and below are the results.

| Source | % People |

|---|---|

| Pensions | 14% |

| Savings | 21% |

| Investments | 14% |

| Social Security | 9% |

| Annuities | 9% |

| Part-time Job | 9% |

| Real Estate | 16% |

| Dividends and Interest | 9% |

Retirement Monthly Expenses in Mexico 3,000 MXN

$180 27,000 MXN

$1,600 300,000 MXN

$18,000

MINIMUM AVERAGE MAXIMUM

| 3,000 MXN $180 | 27,000 MXN $1,600 | 300,000 MXN $18,000 |

| MINIMUM | AVERAGE | MAXIMUM |

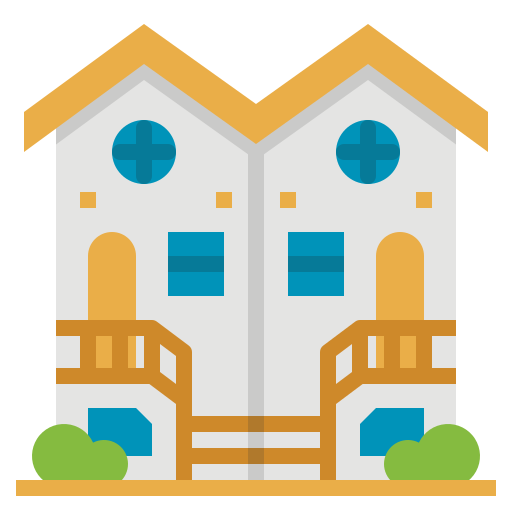

Debt, loans, and mortgages in Mexico

Percentage of people who are in debt

According to the survey, 25% of the people in Mexico have some kind of debt, loan, mortgage, or credit card payments while 75% reported that they don't have financial obligations to banks.

Debt-to-income ratio in Mexico

28%

18% to 37%

( monthly debt payment / monthly income ) x 100

Interpretation

The debt-to-income ratio measures the percentage of income being paid as debt settlement across the population. It is calculated by dividing the monthly debt settlement payment of an individual by their monthly income. Based on collected data, approximately 28% of the people's monthly income in Mexico goes to debt settlement.

Debt levelsMonthly debt settlement payment as percentage of monthly income

| Debt-to-income ratio | % People |

|---|---|

| > 60% | 2% |

| 50% - 60% | 10% |

| 40% - 50% | 10% |

| 30% - 40% | 12% |

| 20% - 30% | 16% |

| 10% - 20% | 20% |

| 0% - 10% | 28% |

According to our data, 2% of the debtors in Mexico pay 60%+ of their income as debt settlement while 10% of the people pay 50% to 60% of their income for the same, which is quite an alarming financial situation for those individuals. 10% of people in debt dedicate 40% to 50% of their income to loan and mortgage payments while 12% dedicated 30% to 40% of income for same. Things are looking brighter for 16% of individuals as they only pay 20% to 30% of their income for loan and credit card repayment.

Distribution by type of debt in Mexico

| Debt | % People |

|---|---|

| Real Estate Mortgage | 14% |

| Auto Loan | 24% |

| Student Loan | 3% |

| Credit Card | 24% |

| Personal Loan | 35% |

14% of debtors in Mexico confirm that real estate mortgages constitutes the main part of their outstanding debt while 24% say that credit card payments are the reason they are in debt. Auto loans were the main type of debt for 24% of people and personal loans rose at 35%. Lastly, student loans are the main source of debt for 3% of debtors in Mexico.

Managing debt is a critical aspect of maintaining a favorable credit score. Debt reduction is the first thing you should do improve your financial situation. Getting rid of debt takes precedence over saving money because of interest rates.

Good debt vs. Bad debt

Not all debt is bad. Good debt typically refers to borrowing money for investments that can increase in value or generate income over time like purchasing a home or acquiring student loans. On the other hand, bad debt involves borrowing for things that fail to generate lasting value like high-interest credit card debt used for non-essential expenses like luxury items or vacations.

Loan Affordability Index in Mexico

Besides measuring the loan-to-income ratio, we asked residents how many times in a year they defaulted or were unable to pay their due credit card or loan payments on time. Understanding how often people default on their due payments is one of the indicators of the cost of living and economic situation.

Frequency and percentage of people who failed to pay their monthly credit card or loan payments on time last year.

| Frequency | % People |

|---|---|

| Never | 56% |

| Once a year | 21% |

| Twice a year | 11% |

| Three times a year | 8% |

| Four times a year | 3% |

Monthly costs and expenses of energy and basic utilities in Mexico

Utilities expenditure can vary slightly between different areas and locations.

Energy, electricity, water, gas, internet, and mobile cost in Mexico

Utility Bill Cost / Electricity + Water + Gas / Individual

| 310 MXN | 2,200 MXN | 25,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $18 | $130 | $1,400 |

Utility Bill Cost / Electricity + Water + Gas / Couple

| 330 MXN | 2,400 MXN | 27,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $19 | $140 | $1,600 |

Utility Bill Cost / Electricity + Water + Gas / Family

| 610 MXN | 3,100 MXN | 31,000 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $36 | $180 | $1,800 |

Internet and cable cost

| 280 MXN | 560 MXN | 750 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $17 | $33 | $44 |

Mobile phone bill and charges

| 230 MXN | 380 MXN | 1,100 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $13 | $22 | $66 |

Because most utility bills club electricity, water, and gas costs in one bill, we can't provide a breakup for each type of utility and will display electricity, gas, and water as single cost.

The average monthly expenditure for individuals on electricty, water, and gas in Mexico ranges between 310 MXN and 25,000 MXN with average being 2,200 MXN, meanwhile the expenditure of couples is slightly higher at 2,400 MXN with 330 MXN and 27,000 MXN being the upper and lower limits respectively. As expected, the energy and water consumption of families is the highest among the three groups with an average of 3,100 MXN. The cost of internet and WiFi is unchanged among the three groups and ranges from 280 MXN to 750 MXN with 560 MXN being the average internet bill. Finally, the average monthly mobile charges is around 380 MXN but can range between 230 MXN and 1,100 MXN depending on consumption. Mobile charges include both calling minutes as well as data packages.

Energy / Utility expense to income ratio

( monthly utility expenses / monthly income ) x 100

| 2% | 5% of income | 9% |

| MINIMUM | AVERAGE | MAXIMUM |

The average utility-to-income ratio in Mexico is around 5%. This means that people pay 5% of their income for energy, water, internet, and mobile charges. Those figures can range from 2% to 9% depending on salary and location.

Food Prices, Dining Expenses, and Grocery Costs in Mexico

Grocery / Food expenditure and prices can vary drastically between different areas and locations.

Prices and cost of goods and services in Mexico

Dining out, food, and beverages costs. Price variations for common food items.

Fast food combo meal price

| 56 MXN | 110 MXN | 190 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $3.3 | $6.6 | $11 |

The average price of a regular combo meal at a fast food outlet or chain like McDonald's, Pizzahut, or KFC in Mexico is approximatly 110 MXN with meal cost ranging from 56 MXN to 190 MXN. The typical combo meal consists of a burger, french fries, and a drink.

Restaurant meal for one price

| 190 MXN | 280 MXN | 560 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $11 | $17 | $33 |

If you are planning to have a nice meal at a mid-range restaurant, expect to pay anywhere between 190 MXN and 560 MXN with 280 MXN being the average price of a plate for one person at a regular restaurant in Mexico.

Fine dining meal for one price

| 380 MXN | 560 MXN | 2,300 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $22 | $33 | $130 |

The price range of a meal at fine-dining restaurant is 380 MXN to 2,300 MXN with the average cost being 560 MXN for one person. This is what you would expect to pay a top-tier diner in Mexico.

Beverage prices, cappuccino, latte etc..

| 47 MXN | 75 MXN | 110 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $2.8 | $4.4 | $6.6 |

The average price of a regular beverage like cappuccino or latte at Starbucks, Costa, or similar coffee shops and cafes in Mexico is around 75 MXN. Price ranges between 47 MXN and 110 MXN depending on the type of beverage, the size, and optional add-ons.

Grocery and market costs

Large bottle of milk price

| 38 MXN | 45 MXN | 56 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $2.2 | $2.7 | $3.3 |

The average price of a large bottle of milk in Mexico is 45 MXN. The maximum what you would pay for milk is 56 MXN and the minimum being 38 MXN depending on the brand of milk and other properties.

12 eggs price

| 28 MXN | 38 MXN | 56 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.7 | $2.2 | $3.3 |

A dozen eggs costs around 38 MXN on average with 28 MXN and 56 MXN being the lower and upper limits respectively.

Fresh whole chicken price

| 64 MXN | 83 MXN | 120 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $3.8 | $4.9 | $6.9 |

The price range of a fresh whole chicken in Mexico is between 64 MXN and 120 MXN depending on the size of the chicken and whether it is oraganic or not. The average price is approximatly 83 MXN.

Pack of beef price

| 75 MXN | 110 MXN | 230 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $4.4 | $6.6 | $13 |

The price of a regular pack of beef or meat is around 110 MXN. A pack of beef contains around 1Kg or 1lb depending on packing.

Medium bag of rice price

| 30 MXN | 41 MXN | 59 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.8 | $2.4 | $3.5 |

A bag of rice in Mexico costs around 41 MXN on average with prices rangeing between 30 MXN and 59 MXN depending on the brand and quality.

Bag of tomatos price

| 11 MXN | 15 MXN | 28 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $0.66 | $0.88 | $1.7 |

A bag of tomatoes costs anywhere from 11 MXN to 28 MXN. A bag of tomatoes denotes 1Kg or 1lb depending on location.

Bag of apples price

| 20 MXN | 26 MXN | 43 MXN |

| MINIMUM | AVERAGE | MAXIMUM |

| $1.2 | $1.6 | $2.6 |

A bag of apples costs 26 MXN on average. A bag of apples denotes 1Kg or 1lb depending on location.

Grocery and food expenditure to income ratio

( monthly grocery expenses / monthly income ) x 100

| 17% | 25% of income | 31% |

| MINIMUM | AVERAGE | MAXIMUM |

The average grocery-to-income ratio in Mexico is around 25%. This means that people spend 25% of their income on grocery and basic household items. The expenditure can range from 17% to 31% depending on salary and location.

Expenditure on food and grocery for every population group

A single person living alone spends approximately 5,900 MXN per month on grocery and food with expenditure fluctuating between 840 MXN and 66,000 MXN depending on location and the type of person. The average cost of food and groceries for a couple is around 7,500 MXN per month. That number can be get as low as 1,100 MXN or a high as 69,000 MXN. Families' spending on grocery ranges from 2,200 MXN to 110,000 MXN with the location, income, and size of the family being the most determinite factors.

Cost of living comparison by city

#1 Navojoa

The average cost of living in Navojoa is 18,000 MXN, which is 56% less than the country average. Navojoa is ranked first in Mexico in terms of expendenture and cost of living.

#2 Hidalgo del Parral

The average cost of living in Hidalgo del Parral is 18,000 MXN, which is 56% less than the country average. Hidalgo del Parral is ranked second in Mexico in terms of expendenture and cost of living.

#3 Guaymas

The average cost of living in Guaymas is 19,000 MXN, which is 54% less than the country average. Guaymas is ranked third in Mexico in terms of expendenture and cost of living.

#4 Minatitlan

The average cost of living in Minatitlan is 19,000 MXN, which is 54% less than the country average. Minatitlan is ranked fourth in Mexico in terms of expendenture and cost of living.

#5 San Pedro Garza Garcia

The average cost of living in San Pedro Garza Garcia is 19,000 MXN, which is 54% less than the country average. San Pedro Garza Garcia is ranked fifth in Mexico in terms of expendenture and cost of living.

#6 Orizaba

The average cost of living in Orizaba is 19,000 MXN, which is 54% less than the country average. Orizaba is ranked sixth in Mexico in terms of expendenture and cost of living.

#7 Fresnillo

The average cost of living in Fresnillo is 20,000 MXN, which is 51% less than the country average. Fresnillo is ranked seventh in Mexico in terms of expendenture and cost of living.

#8 Iguala

The average cost of living in Iguala is 20,000 MXN, which is 51% less than the country average. Iguala is ranked eighth in Mexico in terms of expendenture and cost of living.

#9 Delicias

The average cost of living in Delicias is 21,000 MXN, which is 49% less than the country average. Delicias is ranked ninth in Mexico in terms of expendenture and cost of living.

#10 Zacatecas

The average cost of living in Zacatecas is 21,000 MXN, which is 49% less than the country average. Zacatecas is ranked tenth in Mexico in terms of expendenture and cost of living.

#11 Ciudad Valles

The average cost of living in Ciudad Valles is 22,000 MXN, which is 46% less than the country average. Ciudad Valles is ranked eleventh in Mexico in terms of expendenture and cost of living.

#12 Manzanillo

The average cost of living in Manzanillo is 22,000 MXN, which is 46% less than the country average. Manzanillo is ranked twelfth in Mexico in terms of expendenture and cost of living.

#13 San Juan del Rio

The average cost of living in San Juan del Rio is 23,000 MXN, which is 44% less than the country average. San Juan del Rio is ranked thirteenth in Mexico in terms of expendenture and cost of living.

#14 Zamora de Hidalgo

The average cost of living in Zamora de Hidalgo is 23,000 MXN, which is 44% less than the country average. Zamora de Hidalgo is ranked fourteenth in Mexico in terms of expendenture and cost of living.

#15 Cordoba

The average cost of living in Cordoba is 24,000 MXN, which is 41% less than the country average. Cordoba is ranked fifteenth in Mexico in terms of expendenture and cost of living.

#16 Colima

The average cost of living in Colima is 24,000 MXN, which is 41% less than the country average. Colima is ranked sixteenth in Mexico in terms of expendenture and cost of living.

#17 Playa del Carmen

The average cost of living in Playa del Carmen is 24,000 MXN, which is 41% less than the country average. Playa del Carmen is ranked seventeenth in Mexico in terms of expendenture and cost of living.

#18 Boca del Rio

The average cost of living in Boca del Rio is 24,000 MXN, which is 41% less than the country average. Boca del Rio is ranked eighteenth in Mexico in terms of expendenture and cost of living.

#19 Cuautla

The average cost of living in Cuautla is 25,000 MXN, which is 39% less than the country average. Cuautla is ranked nineteenth in Mexico in terms of expendenture and cost of living.

#20 Piedras Negras

The average cost of living in Piedras Negras is 25,000 MXN, which is 39% less than the country average. Piedras Negras is ranked twentyth in Mexico in terms of expendenture and cost of living.

#21 Chetumal

The average cost of living in Chetumal is 26,000 MXN, which is 37% less than the country average. Chetumal is ranked twenty-onth in Mexico in terms of expendenture and cost of living.

#22 Ciudad Juarez

The average cost of living in Ciudad Juarez is 26,000 MXN, which is 37% less than the country average. Ciudad Juarez is ranked twenty-twoth in Mexico in terms of expendenture and cost of living.

#23 Salamanca

The average cost of living in Salamanca is 27,000 MXN, which is 34% less than the country average. Salamanca is ranked twenty-threth in Mexico in terms of expendenture and cost of living.

#24 San Luis Rio Colorado

The average cost of living in San Luis Rio Colorado is 27,000 MXN, which is 34% less than the country average. San Luis Rio Colorado is ranked twenty-fourth in Mexico in terms of expendenture and cost of living.

#25 Jiutepec

The average cost of living in Jiutepec is 28,000 MXN, which is 32% less than the country average. Jiutepec is ranked twenty-fivth in Mexico in terms of expendenture and cost of living.

#26 Chalco

The average cost of living in Chalco is 28,000 MXN, which is 32% less than the country average. Chalco is ranked twenty-sixth in Mexico in terms of expendenture and cost of living.

#27 Chicoloapan

The average cost of living in Chicoloapan is 29,000 MXN, which is 29% less than the country average. Chicoloapan is ranked twenty-seventh in Mexico in terms of expendenture and cost of living.

#28 Ciudad del Carmen

The average cost of living in Ciudad del Carmen is 29,000 MXN, which is 29% less than the country average. Ciudad del Carmen is ranked twenty-eightth in Mexico in terms of expendenture and cost of living.

#29 Poza Rica

The average cost of living in Poza Rica is 30,000 MXN, which is 27% less than the country average. Poza Rica is ranked twenty-ninth in Mexico in terms of expendenture and cost of living.

#30 San Cristobal de las Casas

The average cost of living in San Cristobal de las Casas is 30,000 MXN, which is 27% less than the country average. San Cristobal de las Casas is ranked thirtyth in Mexico in terms of expendenture and cost of living.

#31 Cholula de Rivadabia

The average cost of living in Cholula de Rivadabia is 31,000 MXN, which is 24% less than the country average. Cholula de Rivadabia is ranked thirty-onth in Mexico in terms of expendenture and cost of living.

#32 San Pablo de las Salinas

The average cost of living in San Pablo de las Salinas is 31,000 MXN, which is 24% less than the country average. San Pablo de las Salinas is ranked thirty-twoth in Mexico in terms of expendenture and cost of living.

#33 Tapachula

The average cost of living in Tapachula is 33,000 MXN, which is 20% less than the country average. Tapachula is ranked thirty-threth in Mexico in terms of expendenture and cost of living.

#34 Chilpancingo

The average cost of living in Chilpancingo is 33,000 MXN, which is 20% less than the country average. Chilpancingo is ranked thirty-fourth in Mexico in terms of expendenture and cost of living.

#35 Nogales

The average cost of living in Nogales is 34,000 MXN, which is 17% less than the country average. Nogales is ranked thirty-fivth in Mexico in terms of expendenture and cost of living.

#36 Puerto Vallarta

The average cost of living in Puerto Vallarta is 34,000 MXN, which is 17% less than the country average. Puerto Vallarta is ranked thirty-sixth in Mexico in terms of expendenture and cost of living.

#37 Buenavista

The average cost of living in Buenavista is 35,000 MXN, which is 15% less than the country average. Buenavista is ranked thirty-seventh in Mexico in terms of expendenture and cost of living.

#38 Metepec

The average cost of living in Metepec is 35,000 MXN, which is 15% less than the country average. Metepec is ranked thirty-eightth in Mexico in terms of expendenture and cost of living.

#39 Monclova

The average cost of living in Monclova is 36,000 MXN, which is 12% less than the country average. Monclova is ranked thirty-ninth in Mexico in terms of expendenture and cost of living.

#40 Acuna

The average cost of living in Acuna is 36,000 MXN, which is 12% less than the country average. Acuna is ranked fortyth in Mexico in terms of expendenture and cost of living.

#41 La Paz

The average cost of living in La Paz is 37,000 MXN, which is 9.8% less than the country average. La Paz is ranked forty-onth in Mexico in terms of expendenture and cost of living.

#42 Campeche

The average cost of living in Campeche is 37,000 MXN, which is 9.8% less than the country average. Campeche is ranked forty-twoth in Mexico in terms of expendenture and cost of living.

#43 Coatzacoalcos

The average cost of living in Coatzacoalcos is 38,000 MXN, which is 7.3% less than the country average. Coatzacoalcos is ranked forty-threth in Mexico in terms of expendenture and cost of living.

#44 Ojo de Agua

The average cost of living in Ojo de Agua is 38,000 MXN, which is 7.3% less than the country average. Ojo de Agua is ranked forty-fourth in Mexico in terms of expendenture and cost of living.

#45 Tehuacan

The average cost of living in Tehuacan is 40,000 MXN, which is 2.4% less than the country average. Tehuacan is ranked forty-fivth in Mexico in terms of expendenture and cost of living.

#46 Soledad de Graciano Sanchez

The average cost of living in Soledad de Graciano Sanchez is 40,000 MXN, which is 2.4% less than the country average. Soledad de Graciano Sanchez is ranked forty-sixth in Mexico in terms of expendenture and cost of living.

#47 Pachuca

The average cost of living in Pachuca is 41,000 MXN, which is same as the country average. Pachuca is ranked forty-seventh in Mexico in terms of expendenture and cost of living.

#48 Oaxaca

The average cost of living in Oaxaca is 41,000 MXN, which is same as the country average. Oaxaca is ranked forty-eightth in Mexico in terms of expendenture and cost of living.

#49 Los Reyes la Paz

The average cost of living in Los Reyes la Paz is 42,000 MXN, which is 2.4% more than the country average. Los Reyes la Paz is ranked forty-ninth in Mexico in terms of expendenture and cost of living.

#50 Uruapan

The average cost of living in Uruapan is 42,000 MXN, which is 2.4% more than the country average. Uruapan is ranked fiftyth in Mexico in terms of expendenture and cost of living.

#51 Los Mochis

The average cost of living in Los Mochis is 44,000 MXN, which is 7.3% more than the country average. Los Mochis is ranked fifty-onth in Mexico in terms of expendenture and cost of living.

#52 Gomez Palacio

The average cost of living in Gomez Palacio is 44,000 MXN, which is 7.3% more than the country average. Gomez Palacio is ranked fifty-twoth in Mexico in terms of expendenture and cost of living.

#53 Ciudad Santa Catarina

The average cost of living in Ciudad Santa Catarina is 45,000 MXN, which is 9.8% more than the country average. Ciudad Santa Catarina is ranked fifty-threth in Mexico in terms of expendenture and cost of living.

#54 Villa Nicolas Romero

The average cost of living in Villa Nicolas Romero is 45,000 MXN, which is 9.8% more than the country average. Villa Nicolas Romero is ranked fifty-fourth in Mexico in terms of expendenture and cost of living.

#55 Coacalco

The average cost of living in Coacalco is 46,000 MXN, which is 12% more than the country average. Coacalco is ranked fifty-fivth in Mexico in terms of expendenture and cost of living.

#56 Ensenada

The average cost of living in Ensenada is 46,000 MXN, which is 12% more than the country average. Ensenada is ranked fifty-sixth in Mexico in terms of expendenture and cost of living.

#57 Ciudad Victoria

The average cost of living in Ciudad Victoria is 48,000 MXN, which is 17% more than the country average. Ciudad Victoria is ranked fifty-seventh in Mexico in terms of expendenture and cost of living.

#58 Tampico

The average cost of living in Tampico is 48,000 MXN, which is 17% more than the country average. Tampico is ranked fifty-eightth in Mexico in terms of expendenture and cost of living.

#59 Ciudad Obregon

The average cost of living in Ciudad Obregon is 49,000 MXN, which is 20% more than the country average. Ciudad Obregon is ranked fifty-ninth in Mexico in terms of expendenture and cost of living.

#60 Ixtapaluca

The average cost of living in Ixtapaluca is 49,000 MXN, which is 20% more than the country average. Ixtapaluca is ranked sixtyth in Mexico in terms of expendenture and cost of living.

#61 Cuernavaca

The average cost of living in Cuernavaca is 51,000 MXN, which is 24% more than the country average. Cuernavaca is ranked sixty-onth in Mexico in terms of expendenture and cost of living.

#62 Tepic

The average cost of living in Tepic is 51,000 MXN, which is 24% more than the country average. Tepic is ranked sixty-twoth in Mexico in terms of expendenture and cost of living.

#63 Celaya

The average cost of living in Celaya is 52,000 MXN, which is 27% more than the country average. Celaya is ranked sixty-threth in Mexico in terms of expendenture and cost of living.

#64 Xico

The average cost of living in Xico is 52,000 MXN, which is 27% more than the country average. Xico is ranked sixty-fourth in Mexico in terms of expendenture and cost of living.

#65 General Escobedo

The average cost of living in General Escobedo is 54,000 MXN, which is 32% more than the country average. General Escobedo is ranked sixty-fivth in Mexico in terms of expendenture and cost of living.

#66 Villahermosa

The average cost of living in Villahermosa is 54,000 MXN, which is 32% more than the country average. Villahermosa is ranked sixty-sixth in Mexico in terms of expendenture and cost of living.

#67 Nuevo Laredo

The average cost of living in Nuevo Laredo is 55,000 MXN, which is 34% more than the country average. Nuevo Laredo is ranked sixty-seventh in Mexico in terms of expendenture and cost of living.

#68 Mazatlan

The average cost of living in Mazatlan is 55,000 MXN, which is 34% more than the country average. Mazatlan is ranked sixty-eightth in Mexico in terms of expendenture and cost of living.

#69 Irapuato

The average cost of living in Irapuato is 57,000 MXN, which is 39% more than the country average. Irapuato is ranked sixty-ninth in Mexico in terms of expendenture and cost of living.

#70 Tonala

The average cost of living in Tonala is 57,000 MXN, which is 39% more than the country average. Tonala is ranked seventyth in Mexico in terms of expendenture and cost of living.

#71 Veracruz

The average cost of living in Veracruz is 59,000 MXN, which is 44% more than the country average. Veracruz is ranked seventy-onth in Mexico in terms of expendenture and cost of living.

#72 Xalapa

The average cost of living in Xalapa is 59,000 MXN, which is 44% more than the country average. Xalapa is ranked seventy-twoth in Mexico in terms of expendenture and cost of living.

#73 Matamoros

The average cost of living in Matamoros is 60,000 MXN, which is 46% more than the country average. Matamoros is ranked seventy-threth in Mexico in terms of expendenture and cost of living.

#74 San Nicolas de los Garza

The average cost of living in San Nicolas de los Garza is 60,000 MXN, which is 46% more than the country average. San Nicolas de los Garza is ranked seventy-fourth in Mexico in terms of expendenture and cost of living.

#75 Ciudad Apodaca

The average cost of living in Ciudad Apodaca is 62,000 MXN, which is 51% more than the country average. Ciudad Apodaca is ranked seventy-fivth in Mexico in terms of expendenture and cost of living.

#76 Toluca

The average cost of living in Toluca is 62,000 MXN, which is 51% more than the country average. Toluca is ranked seventy-sixth in Mexico in terms of expendenture and cost of living.

#77 Cuautitlan Izcalli

The average cost of living in Cuautitlan Izcalli is 64,000 MXN, which is 56% more than the country average. Cuautitlan Izcalli is ranked seventy-seventh in Mexico in terms of expendenture and cost of living.

#78 Ciudad Lopez Mateos

The average cost of living in Ciudad Lopez Mateos is 64,000 MXN, which is 56% more than the country average. Ciudad Lopez Mateos is ranked seventy-eightth in Mexico in terms of expendenture and cost of living.

#79 Durango

The average cost of living in Durango is 66,000 MXN, which is 61% more than the country average. Durango is ranked seventy-ninth in Mexico in terms of expendenture and cost of living.

#80 Tuxtla Gutierrez

The average cost of living in Tuxtla Gutierrez is 66,000 MXN, which is 61% more than the country average. Tuxtla Gutierrez is ranked eightyth in Mexico in terms of expendenture and cost of living.

#81 Reynosa

The average cost of living in Reynosa is 67,000 MXN, which is 63% more than the country average. Reynosa is ranked eighty-onth in Mexico in terms of expendenture and cost of living.

#82 Tlaquepaque

The average cost of living in Tlaquepaque is 67,000 MXN, which is 63% more than the country average. Tlaquepaque is ranked eighty-twoth in Mexico in terms of expendenture and cost of living.

#83 Morelia

The average cost of living in Morelia is 69,000 MXN, which is 68% more than the country average. Morelia is ranked eighty-threth in Mexico in terms of expendenture and cost of living.

#84 Torreon

The average cost of living in Torreon is 69,000 MXN, which is 68% more than the country average. Torreon is ranked eighty-fourth in Mexico in terms of expendenture and cost of living.

#85 Queretaro

The average cost of living in Queretaro is 71,000 MXN, which is 73% more than the country average. Queretaro is ranked eighty-fivth in Mexico in terms of expendenture and cost of living.

#86 Chimalhuacan

The average cost of living in Chimalhuacan is 71,000 MXN, which is 73% more than the country average. Chimalhuacan is ranked eighty-sixth in Mexico in terms of expendenture and cost of living.

#87 Tlalnepantla de Baz

The average cost of living in Tlalnepantla de Baz is 73,000 MXN, which is 78% more than the country average. Tlalnepantla de Baz is ranked eighty-seventh in Mexico in terms of expendenture and cost of living.

#88 Cancun

The average cost of living in Cancun is 73,000 MXN, which is 78% more than the country average. Cancun is ranked eighty-eightth in Mexico in terms of expendenture and cost of living.

#89 Guadalupe

The average cost of living in Guadalupe is 75,000 MXN, which is 83% more than the country average. Guadalupe is ranked eighty-ninth in Mexico in terms of expendenture and cost of living.

#90 Acapulco

The average cost of living in Acapulco is 75,000 MXN, which is 83% more than the country average. Acapulco is ranked ninetyth in Mexico in terms of expendenture and cost of living.

#91 San Luis Potosi

The average cost of living in San Luis Potosi is 77,000 MXN, which is 88% more than the country average. San Luis Potosi is ranked ninety-onth in Mexico in terms of expendenture and cost of living.

#92 Mexicali

The average cost of living in Mexicali is 77,000 MXN, which is 88% more than the country average. Mexicali is ranked ninety-twoth in Mexico in terms of expendenture and cost of living.

#93 Hermosillo

The average cost of living in Hermosillo is 79,000 MXN, which is 93% more than the country average. Hermosillo is ranked ninety-threth in Mexico in terms of expendenture and cost of living.

#94 Saltillo

The average cost of living in Saltillo is 79,000 MXN, which is 93% more than the country average. Saltillo is ranked ninety-fourth in Mexico in terms of expendenture and cost of living.

#95 Aguascalientes

The average cost of living in Aguascalientes is 81,000 MXN, which is 98% more than the country average. Aguascalientes is ranked ninety-fivth in Mexico in terms of expendenture and cost of living.

#96 Merida

The average cost of living in Merida is 81,000 MXN, which is 98% more than the country average. Merida is ranked ninety-sixth in Mexico in terms of expendenture and cost of living.

#97 Culiacan

The average cost of living in Culiacan is 83,000 MXN, which is 100% more than the country average. Culiacan is ranked ninety-seventh in Mexico in terms of expendenture and cost of living.

#98 Naucalpan

The average cost of living in Naucalpan is 83,000 MXN, which is 100% more than the country average. Naucalpan is ranked ninety-eightth in Mexico in terms of expendenture and cost of living.

#99 Chihuahua

The average cost of living in Chihuahua is 85,000 MXN, which is 110% more than the country average. Chihuahua is ranked ninety-ninth in Mexico in terms of expendenture and cost of living.

#100 Nezahualcoyotl

The average cost of living in Nezahualcoyotl is 85,000 MXN, which is 110% more than the country average. Nezahualcoyotl is ranked one hundredth in Mexico in terms of expendenture and cost of living.

#101 Zapopan

The average cost of living in Zapopan is 88,000 MXN, which is 110% more than the country average. Zapopan is ranked one hundred onth in Mexico in terms of expendenture and cost of living.

#102 Monterrey

The average cost of living in Monterrey is 88,000 MXN, which is 110% more than the country average. Monterrey is ranked one hundred twoth in Mexico in terms of expendenture and cost of living.

#103 Leon

The average cost of living in Leon is 90,000 MXN, which is 120% more than the country average. Leon is ranked one hundred threth in Mexico in terms of expendenture and cost of living.

#104 Tijuana

The average cost of living in Tijuana is 90,000 MXN, which is 120% more than the country average. Tijuana is ranked one hundred fourth in Mexico in terms of expendenture and cost of living.

#105 Guadalajara

The average cost of living in Guadalajara is 92,000 MXN, which is 120% more than the country average. Guadalajara is ranked one hundred fivth in Mexico in terms of expendenture and cost of living.

#106 Puebla

The average cost of living in Puebla is 92,000 MXN, which is 120% more than the country average. Puebla is ranked one hundred sixth in Mexico in terms of expendenture and cost of living.

#107 Ecatepec de Morelos

The average cost of living in Ecatepec de Morelos is 94,000 MXN, which is 130% more than the country average. Ecatepec de Morelos is ranked one hundred seventh in Mexico in terms of expendenture and cost of living.

#108 Mexico City

The average cost of living in Mexico City is 94,000 MXN, which is 130% more than the country average. Mexico City is ranked one hundred eightth in Mexico in terms of expendenture and cost of living.

Published: September 3, 2024 Last Update: November 19, 2025